Teamwork is our greatest passion

About us

Audere Invest SA is a financial advisory firm based in Lugano that addresses private, institutional and corporate clients to provide assistance in investment decisions and in the structuring of corporate and family business.

Our advisors are registered in the register of Swiss financial advisors RegFix.

ASSET MANAGEMENT

In the field of asset management, Audere Invest is primarily an advisor to banks and asset managers to whom it provides a wide range of investment strategies. These strategies are applied both within investment funds, through actively managed certificates (AMCs) and through structured products.

Example

Audere Invest is currently the advisor of a number of actively managed certificates (AMCs) listed on the Vienna Stock Exchange and the Milan Stock Exchange, which implement investment strategies based on the gold index, major stock indices and oil with the aim of producing 'market neutral' results, i.e. decoupled from the general market trend.

FAMILY BUSINESS CONSULTING

Thanks to a network of well-established relationships with banks, asset management companies, trust companies, tax advisors and lawyers, Audere intervenes in several critical aspects of the family business, including asset protection, the creation of new corporate vehicles, corporate restructuring, business internationalisation, the establishment of trusts and foundations as well as corporate treasury optimisation.

INVESTMENT CLUB

The activity of investment evaluation and contact with institutional players allows us to select investment opportunities in which we act primarily as investors with the aim of sharing these investments with our partners and clients. This activity is carried out through investment clubs for financial, commercial and industrial transactions of which we are promoters.

INDIVIDUALS AND FAMILY BUSINESSES

COMPANIES

- Treasury management

- Bond issue

- Securitization of assets

- Private equity and investment clubs

- Access to European funding

BANKS AND MANAGEMENT COMPANIES

- Wealth management consultancy

- Design of dedicated investment strategies

- Structured product design

- Establishment of funds and investment vehicles

- Issuance of actively managed certificates

The Quantitative Analysis team

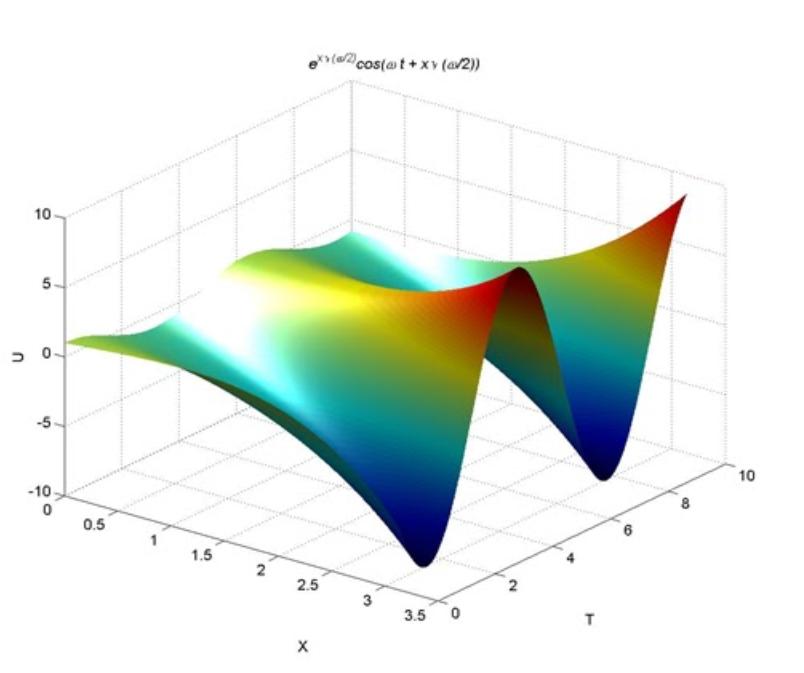

The fulcrum of the research and development activity is represented by an internal quantitative team which constitutes a laboratory for continuous research and experimentation on the subject of financial markets and products.

Research and development

Audere considers investment in research and development as the distinctive strategic factor that allows the company to present itself to the market with unique and well-differentiated products compared to the market average.

Template

Our research team has developed a quantitative model that uses macro-economic variables to predict the price performance of shares, precious metals, currencies and rates.

SUBJECTS

Peggiorano i fondamentali

Nei mercati prevale ancora la fiducia in una frenata dei tassi COSA ACCADE I recenti dati macro-economici USA, aumento della disoccupazione e sgretolamento dei consumi, sono stati accolti con moderato ottimismo dalle Borse americane che sperano nella fine dell’aumento...

Ancora aumento di tassi

FED e BCE continuano sui tassi COSA ACCADE Jerome Powell della FED ha detto che l’inflazione è ancora troppo alta e non esclude che ulteriori aumenti dei tassi saranno necessari. Ha aggiunto che nonostante gli 11 aumenti dei tassi degli ultimi 18 mesi, l’economia...

Più debiti con tassi più alti

Come l’aumento dei tassi può alimentare l’inflazione COSA ACCADE La lotta all’inflazione tramite il prolungato aumento dei tassi di intesse sta inasprendo la situazione delle bolle immobiliari e creditizie che caratterizzano sia l’economia cinese che quella americana....

TEAM

Carlotta Balzani

Financial advisor

Alfredo Santacroce

Corporate services

Matteo Pellizzari

Analista quantitativo

Quantitative analyst, he holds a Masters in Economics & Finance from the University of Venice and a Degree in Economics and Commerce. After that,..

Ioannis Fotinopoulos

Quantitative models

University researcher in the UK, he holds a Ph.D in Quantitative Finance and a second Ph.D in Signal Processing Communications at Imperial College London…

In the 90s he worked as an entrepreneur in the construction sector and in the distribution of consumer products, which include the self-service distribution network called Brigo ok”.

It maintains consolidated relationships with the main Swiss banks both for the management of the corporate treasury and for the financing of commercial and industrial operations.

Dr. Foutinopoulos is the author of a quantitative model for forecasting the prices of financial instruments linked to commodities, forex and large cap equities.

Within Audere Invest he carries out a role of quantitative researcher with the responsibility of producing trading signals for the benefit of the managers.

Quantitative analyst, he holds a Masters in Economics & Finance from the University of Venice and a Degree in Economics and Commerce.

Following this, he gained numerous experiences both of a consultancy nature for the benefit of Italian asset management companies, such as Anima SGR, and of a managerial nature, in relation to an investment fund managed by Nextra Investment Management SGR, of the Banca Intesa group .

Within Audere Invest he carries out the role of statistical analyst with the responsibility of producing trading signals for the benefit of the managers as well as building risk management models.

CONTACT US

Via Riva Vincenzo Vela 12, 6900 Lugano (Svizzera)

T: +41 91 921 42 63

compliance@audereinvest.ch

CHE 459.541.559

www.audereinvest.ch

Contact:

- Carlotta Balzani

- Financial advisor

- carlotta@audereinvest.ch